Navigating the Bankruptcy Maze: Everything You Need to Know About Insolvency Courts and Your Debt Relief Options

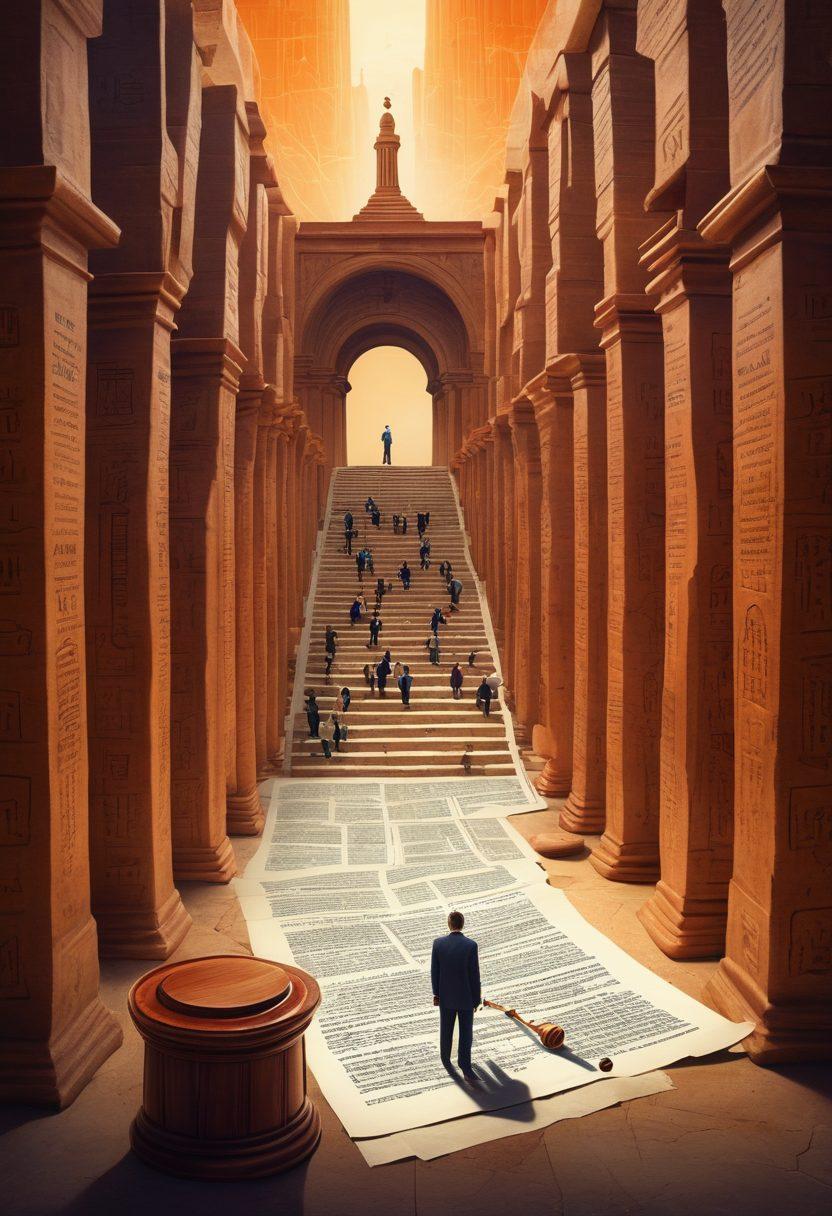

Welcome to the labyrinth of the insolvency court, where hope intertwines with complexity. If you’re standing at the precipice of financial distress, you might be wondering if navigating these murky waters is worth it. What if everything you learned about bankruptcy regulations was just the tip of the iceberg? The truth is, understanding the ins and outs of insolvency courts in the United States can be transformative for your financial future. Whether you’re considering a chapter 7 bankruptcy, searching for debt relief options, or seeking financial rehabilitation, we’re here to illuminate your path with actionable insights and vital information.

Insolvency courts are designed to help individuals and businesses who are struggling under the weight of overwhelming debt. But before you decide to embark on this journey, let’s explore a crucial question: What does the process entail? Imagine you’re about to make a significant life decision; would you throw yourself into the deep end without understanding how to swim? Of course not! By educating yourself on the intricacies of judicial proceedings and court guidelines, you can avoid potential setbacks and navigate through this challenging time with confidence. Do you know the different types of bankruptcy filings available to you?

Chapter 7 bankruptcy offers a clean slate for many individuals, wiping out most unsecured debts through asset liquidation. However, it’s not just a matter of walking into the insolvency court and requesting a fresh start. You will need to file a bankruptcy petition meticulously and follow specific court filings, which is where having a knowledgeable bankruptcy attorney can make all the difference. Remember, you're not alone in this; countless professionals are ready to provide bankruptcy support and legal services tailored to your unique circumstances. The more you know, the more empowered you become to take control of your financial destiny.

On the other hand, if your situation requires a more structured repayment plan, a chapter 13 bankruptcy may be your route to financial freedom. This path can ultimately protect your assets while working toward manageable debt management. What happens to your creditors' rights, you ask? The court will help ensure a fair distribution of your finances. Reaching out for financial counseling can also equip you with the necessary skills to handle finances post-bankruptcy, setting you up for success in credit repair and a brighter future. Have you taken stock of your financial situation before making this life-altering decision?

In summary, conquering the insolvency court landscape may seem daunting, but it can lead you to a life free from the shackles of debt. Engage with bankruptcy education, lean on experienced bankruptcy attorneys, and explore various debt relief options available to you. It's a multi-faceted journey towards recovery, but with the right information and support system in place, you can emerge stronger and more financially informed. After all, the first step in any journey begins with a single decision: Are you ready to take back control of your financial future?

Understanding Bankruptcy Regulations: Your Roadmap to Effective Debt Relief Options

Understanding bankruptcy regulations is like having a roadmap in an intricate maze. When faced with overwhelming debt, navigating through insolvency court can seem daunting. Yet, knowing how to interpret bankruptcy laws can lead you towards effective debt relief options, providing an opportunity for financial rehabilitation. Whether it’s chapter 7 bankruptcy or chapter 13 bankruptcy, the essence of these legal actions is to give honest debtors a second chance. How do you start this journey, and what are the steps involved? Let’s explore the road ahead.

When you step into the world of bankruptcy, it's vital to be equipped with the right knowledge. The United States bankruptcy system is governed by federal regulations that outline court guidelines for debtors and creditors alike. At the heart of this process are judicial proceedings that facilitate the assessment of a bankruptcy petition. The journey often begins with filing court documents, which may feel overwhelming. However, think of it as taking the first step towards a fresh financial start. Have you ever wondered how those first steps impact your journey to debt management?

Exploring debt relief options can be likened to weighing the scales of justice. On one side, you have creditors' rights; on the other, the burden of your debt. The balance may lie in considerations like asset liquidation or debts restructured under a chapter 13 bankruptcy plan. For many individuals, consulting a bankruptcy attorney is a crucial part of this process. A knowledgeable practitioner can demystify bankruptcy regulations and advocate for your best interests. Remember, understanding these regulations may not only protect your assets but also empower you to reclaim your financial freedom. How might your life change by taking this critical step?

For those overwhelmed by the thought of legal proceedings, bankruptcy support can offer comfort. Whether you're looking for financial counseling or assistance with court filings, various resources exist to help you along the way. Legal services that focus on bankruptcy can provide tailored assistance to address your unique situation. Have you considered how reaching out for support might ease your burden? There’s no shame in seeking help—it’s a sign of strength and willingness to take charge of your financial destiny.

And so, the question remains: Are you ready to face the maze of bankruptcy? By understanding bankruptcy regulations and the resources available, you can transform your financial outlook. With each piece of knowledge, you gain clarity on your options, whether that involves credit repair or embarking on a structured path through insolvency court. The road to recovery can be complex, but with the right guidance and knowledge, it can also lead to financial rebirth. So, take a deep breath, arm yourself with information, and step forward into a future free from the shackles of debt.

The Role of Bankruptcy Attorneys: Navigating Legal Actions for Financial Rehabilitation

When life feels like an unrelenting storm of financial obligations, the term 'bankruptcy' may echo through your mind. However, have you ever wondered what lies behind that daunting door? The role of a bankruptcy attorney becomes pivotal as they act as your compass, guiding you through the turbulent waters of insolvency court and towards financial rehabilitation. With the complexities of United States bankruptcy regulations at play, understanding the legal actions required for your debt relief options is crucial. So, let’s unpack what a bankruptcy attorney truly offers and how they can steer you towards calmer seas.

Imagine standing before a towering stack of bills, each representing a creditor's rights to collect what you owe. You may feel powerless in these judicial proceedings, but this is exactly where a skilled bankruptcy attorney steps in. They possess intricate knowledge of court guidelines and nuanced bankruptcy regulations, offering you the best strategies to move forward. Whether you are considering a chapter 7 bankruptcy, which involves asset liquidation, or chapter 13 bankruptcy, which focuses on debt management and repayment plans, your attorney will help clarify your situation and outline the best course of action.

Life can throw unexpected financial challenges our way, making it essential to seek bankruptcy support. A bankruptcy attorney doesn’t just file a bankruptcy petition or manage court filings; they serve as your advocate and advisor. Picture having someone in your corner who not only understands the labyrinth of legal services but can also provide you with personalized financial counseling. They can explain critical elements such as credit repair after bankruptcy and help you reclaim your financial future, transforming what might seem like an insurmountable obstacle into manageable steps.

As you consider your potential debt relief options, it is natural to have intimidating questions: 'Will I lose everything? What about my home? Will this follow me forever?' These concerns can lead to paralyzing anxiety, but a bankruptcy attorney can address these worries head-on. Their experience in the field means they’ve faced countless similar dilemmas and have successfully guided many individuals towards financial recovery. They will take the time to help you understand the implications of your choices while advocating for your best interests, putting your mind at ease as you embark on this journey.

In the end, working with a bankruptcy attorney isn’t merely about navigating the intricacies of insolvency court; it’s about equipping yourself with knowledge and support to reclaim your autonomy over your financial destiny. Are you ready to take the first step? By enlisting the help of a qualified bankruptcy attorney, you are not just seeking legal assistance – you are actively choosing a brighter, more informed path to financial rehabilitation. Remember, amidst the uncertainty, you are not alone, and there is a viable solution waiting just around the corner.